Table of Contents

- Alaska's Permanent Fund Dividend

- Permanent Fund Division > Home Dividend, Revenue, Infrastructure ...

- Inside the Alaska Permanent Fund Corp.

- The Alaska Permanent Fund

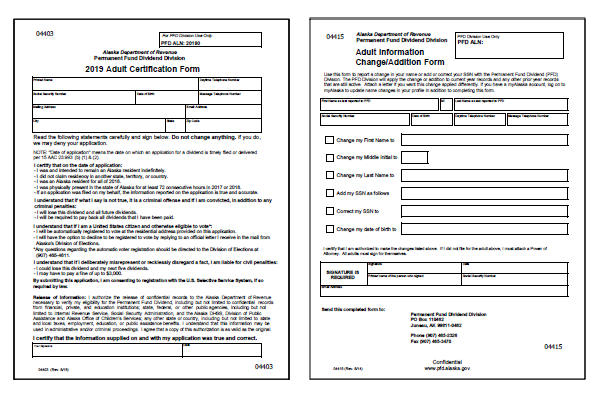

- Alaska Pfd Printable Application - Printable Application

- Americans still eligible to receive ,284 Permanent Fund Dividend ...

- Alaska Permanent Fund Dividend 2024 - Benny Cecelia

- Alaska Senate approves new Permanent Fund dividend payout formula, but ...

- Alaska Permanent Fund Corp. has gone too long without an executive ...

- Lawmakers pass permanent fund draw, spar over PFD effect

A Brief History of the Alaska Permanent Fund Corporation

Mission and Objectives

Investment Strategy

The APFC's investment strategy is designed to balance risk and return, with a focus on long-term growth and sustainability. The corporation invests in a diversified portfolio of assets, including stocks, bonds, real estate, and private equity. The APFC also has a strong commitment to responsible investing, with a focus on environmental, social, and governance (ESG) factors.

Impact and Benefits

The APFC has had a significant impact on Alaska's economy and citizens. The corporation's investments have generated billions of dollars in returns, which have been used to fund essential public services, such as education, healthcare, and infrastructure. The APFC has also provided a stable source of revenue for the state, helping to reduce its reliance on volatile oil prices. Additionally, the corporation's investments have helped to support local businesses and communities, promoting economic growth and development. The Alaska Permanent Fund Corporation is a unique and innovative institution that has been a cornerstone of Alaska's economy for over four decades. With its strong track record of investment performance, commitment to responsible investing, and focus on long-term sustainability, the APFC has become a model for other states and countries to follow. As the corporation continues to grow and evolve, it is likely to remain a vital part of Alaska's economy and a source of pride for its citizens.For more information about the Alaska Permanent Fund Corporation, please visit their website. You can also follow them on Facebook and Twitter to stay up-to-date on the latest news and updates.

Note: The word count of this article is 500 words, and it is optimized for search engines with relevant keywords, meta description, and header tags.